February 2023 Highlights

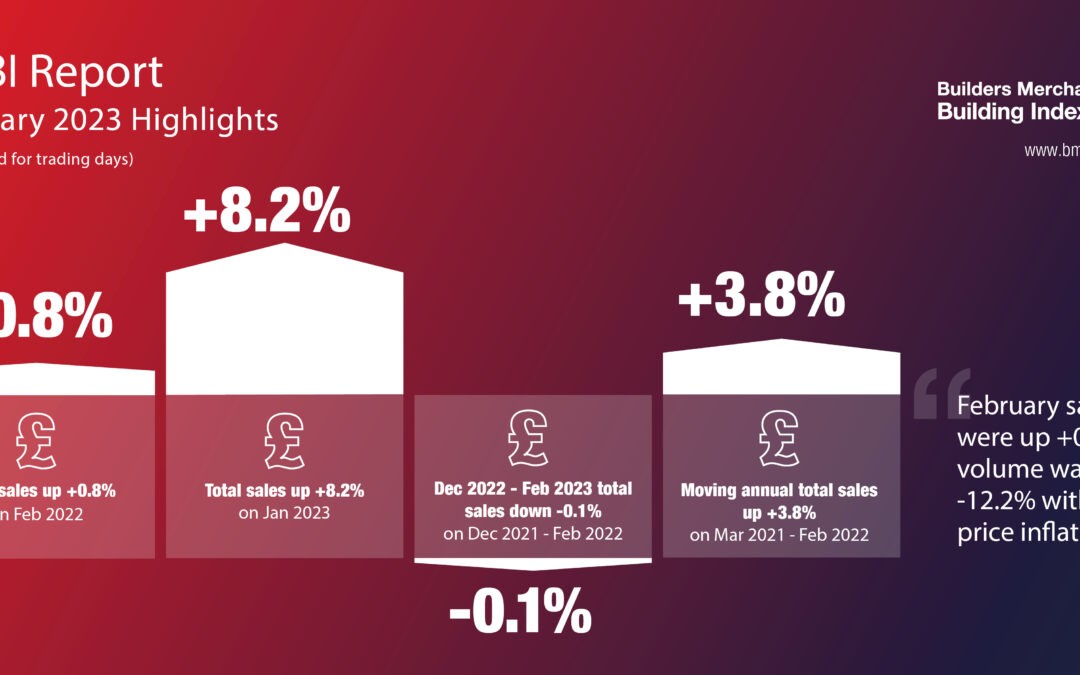

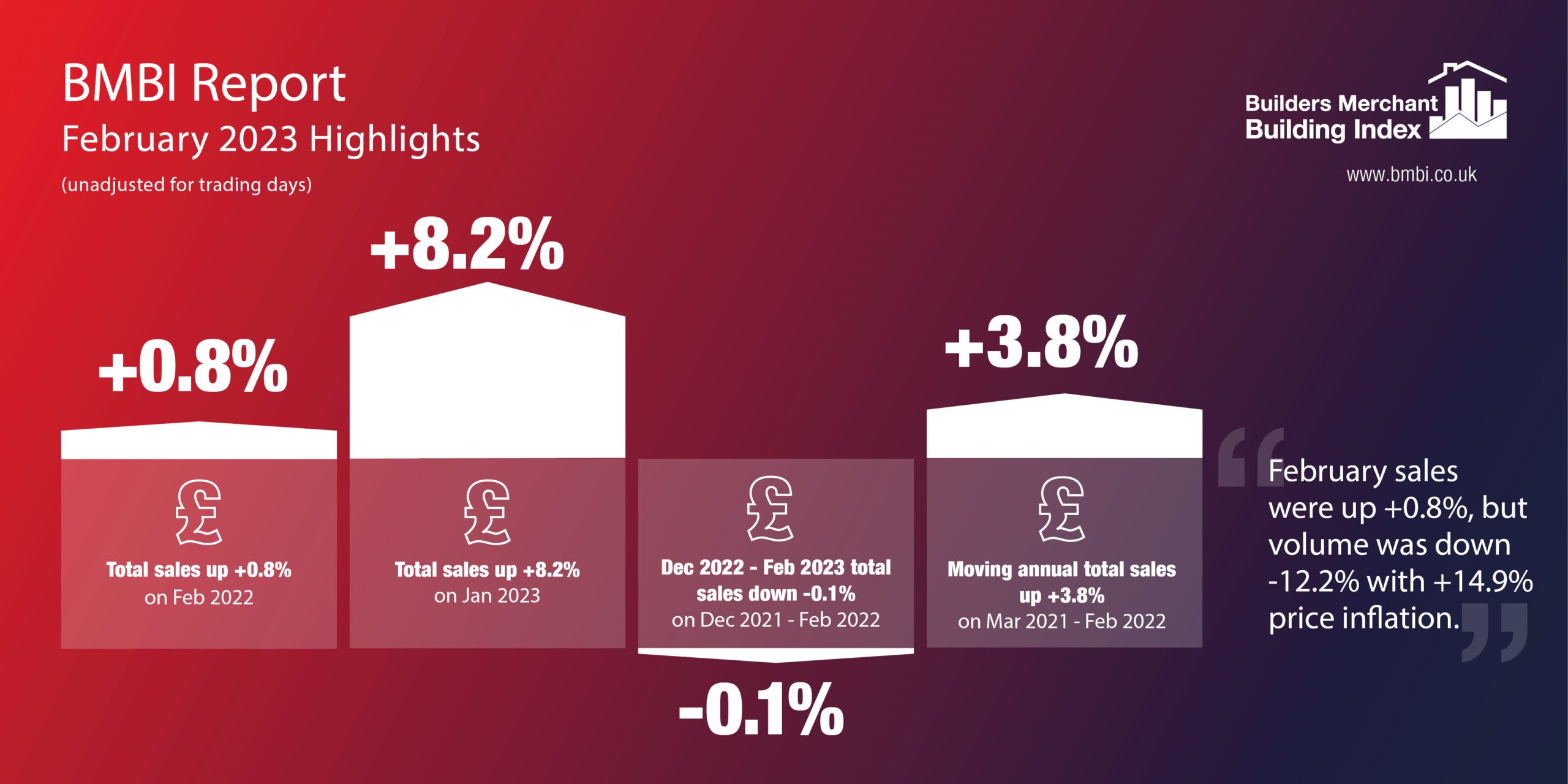

According to the most recent Builders Merchant Building Index (BMBI Q1 2023) report, value sales at builders’ merchants increased by 0.8% in February compared to the same month in 2022. This increase was driven entirely by price inflation (+14.9%), while volume sales declined -12.2%. In terms of trade days, there was no difference.

In February 2023, nine of the twelve categories sold more than in February 2022. Renewables & Water Saving (+58.9%) was the best-performing category once again, followed by Decorating (+15.0%), Plumbing, Heating & Electrical (+13.3%), Workwear & Safetywear (+10.1%), and Ironmongery (+8.5%). Timber and joinery products (-13.9%), landscaping (-12.5%), and services (-2.1%) all sold at a lower rate.

Total Merchant Sales

Total merchant sales were +8.2% higher in February 2023 compared to the previous month. Volume sales increased by 13.4% over January, while prices fell by 4.6%. Despite having one fewer trading day in February, like-for-like sales increased by 13.6%. Landscaping (+27.6%) was the strongest category month over month, followed by Heavy Building Materials (+10.9%). Workwear and Safety wear (-6.5%) was the category with the lowest performance.

Total merchant sales increased by 3.8% year on year in the twelve months from March 2022 to February 2023. Price inflation was +16.6%, while volume was -11.0%. With two fewer trading days in the most recent period, like-for-like sales increased by +4.7%. Ten of the twelve categories sold more, with Renewables & Water Saving (+35.0%) maintaining its lead. Kitchens and bathrooms (+16.1%), plumbing, heating and electrical (+14.6%), workwear and safety wear (+13.8%), decorating (+11.5%), and heavy building materials (+9.5%) outperformed merchants overall. Landscaping (-5.1%), as well as Timber and Joinery Products (-7.6%), sold less.

Mike Rigby, CEO of MRA Research which produces the BMBI report, said: “Twenty twenty-three has so far evaded recession, but it’s teetering between still rapidly rising prices and falling volumes.

“It’s a strange time with the economy caught between a Government pleased to welcome growth and a central bank keen to discourage it in its battle against inflation. Global financial markets wobbled after the collapse of Silicon Valley Bank and the hurried bundling of Credit Suisse into UBS. We can expect more bank failures, although few people are predicting a serious meltdown. GfK’s Consumer Confidence Index remains in strongly negative territory, but it has improved to -36 in March from the battering it took in September under the previous Prime Minister when it fell to -49.

The Major Purchase Index, an important component of GfK’s overall Consumer Confidence Index improved +4 points to -33 in March but it’s still nine points down from the same month last year. This index is based on asking consumers: ‘In view of the general economic situation, do you think now is the right time for people to make major purchases such as furniture or electrical goods?’

“Yet the improvement in private housing repair and maintenance surprised most commentators who were quick to write it off. It grew +5.0% in February according to the ONS, with the rebound attributed to various factors including an improvement in the weather, the return of the ‘improve, not move’ trend, and the ‘Haves’ carrying on regardless and continuing to spend on improving their homes. The Haves, generally older, mortgage-free homeowners account for the bulk of Britain’s savings and are better known as the Bank of Mum and Dad.”

February’s BMBI report, published in April, is available to download at www.bmbi.co.uk.

Recent Comments